邓普顿投资备忘录(1950)之优质股

14 Jun 2019目录

什么是优质股(Best Stocks)? 当别人在说优质股的时候, 你有没有想过到底什么是优质股, 你有自己的理解么? 看看邓普顿在投资备忘录中怎么说.

Which are the Best Stocks1

From: Letter to Clients December 1950

After an investor has decided the percentage of total funds which he should keep in common stocks, then he faces the problem of selecting the best stocks. The investor does not wish to purchase a list of stocks selected at random, but rather he wishes to purchase only those stocks which are the best.

每个人都想选择优质股, 那么对于不同的人, “优质股”是不是有不同的定义呢?

1 stocks of “high investment quality”

Some people, especially institutional investors and trustees, use the words “best stocks” to mean stocks of “high investment quality.” Stocks of high investment quality are those having a tendency to rise very little in favorable markets and to decline very little in unfavorable markets. These are usually stocks of large and famous corporations, having a long record of steady dividends. It is a simple matter for an experience investor to make a list of those stocks having high investment quality. There is little disagreement among security analysts in determining which stocks deserve this rating.

2 stocks having “a good short-term outlook”

Other people use the words “best stocks” to mean stocks having “a good short-term outlook.” In fact, this is the viewpoint most frequently used in selecting stocks. A stock may be selected because the company is expected to pay an extra dividend, because the company is expected to have an increase in sales volume next year, or because of a rumor that the stock may be split. This tendency to emphasize the temporary outlook is the cause for the wide fluctuation in price which most stocks undergo every year.

3 邓普顿定义”best stocks”: 市价低于公司内在价值的股票.

Now when we use the words “best stocks,” we mean simply the best values—that is to say, those stocks whose market prices are lowest in relation to their intrinsic value. The question of investment quality and the question of short-term outlook are only two among the multitude of factors which must be computed and combined in the complex task of estimating the intrinsic value. For each stock we arrive at a specific estimate of intrinsic value. These estimates are kept up-to-date by frequent review. Each month the market price for each stock is compared with the estimated intrinsic value of that stock.

当公司市价低于公司内在价值时, 买入该公司股权. 公司的市价很容易得到, 那么如何判断公司的内在价值呢? 你有没有一套方法判断公司内在价值呢?

公司市价的最低点, 你能预测么? 如果你无法预测, 是不是判断公司内在价值更合理一些呢? 等待市价低于其内在价值, 到达某一区域, 开始建仓.

定期评估公司内在价值, 定期更新, 这个定期的周期是多少? 可以是一个月, 一季度, 半年, 一年? 你觉得那个更适合你呢?

何时卖出呢?

When the market price for a particular stock rises above intrinsic value to an unreasonable extent, we notify clients holding that stock and suggest that the stock should be sold. Conversely, when the market price falls below the intrinsic value for a particular stock to an unreasonable extent, we put that stock on a list of “stocks which can be recommended to clients for purchase.”

评估公司的价值, 需要分析时考虑所有因素, 比如: 公司管理能力, 增长趋向, 政府控制, 每股净资产, 历史平均股价, 股息水平, 当前盈利水平, 历史盈利水平和预期的未来盈利.

To appraise the value of a stock the analyst must consider not just one or two but all factors. Some of these factors are management ability, growth trend, government control, assets per share, average past market prices for the shares, dividends, current earnings, average earnings in previous years, estimates of future earnings, etc.

评估公司内在价值需要投资者一直有逻辑地, 系统地分析研究公司, 总比那些”外行”要有优势.

The appraisal of value is complex and subject to numerous uncertainties. It should not be expected that all selections made on this basis, or any other basis, can prove successful. But although the “intrinsic value” is only an estimate, the person or company whose studies are crystalized logically, systematically and consistently into a specific estimate has an advantage over other stock purchasers and sellers whose ideas are often nebulous and incomplete. A comprehensive and systematic analysis reduces the human tendency to overemphasize one or two dramatic factors and overlook others.

评估公司价值复杂且受制于各种不确定因素. 我们不应当期待在此基础上或其他基础上做出的选择被证明是成功的。但是尽管“内在价值”只是一个估计值,根据这种一致的逻辑清晰的系统研究所得算出估计值的公司或个人,相对于那些观念含糊且不完善的股票买卖者总是有优势的。广泛而系统的研究减少了对戏剧性因素过度反应或反应不足的人类天性。2

The investor who purchases a stock because of basic value can enjoy a certain peace of mind. If after purchasing a stock at a low price in relation to value, the price continues to decline, then it is simply a better bargain than it was before. On the other hand, the speculator who purchases in the hope of a quick profit places himself at the mercy of market fluctuations, because he can succeed only by selling his shares to other speculators at higher prices.

长期内在价值投资者面临的一些问题:(1) 通常要买入不受大众欢迎的公司, 逆向投资, 只有不受市场大众欢迎, 价格才低廉; (2) 长期内在价值投资者不要期望购入公司股票后立即盈利.

The investor who selects stocks on the basis of long-term intrinsic value must expect certain problems.

(1) 买入不受大众欢迎的公司

In the first place, he should expect usually to purchase stocks which are thoroughly unpopular. Only when a stock is unpopular is the price likely to be depressed greatly below intrinsic value. It is not easy to act contrary to popular opinion. When the price of a stock is very low, there are usually obvious reasons which have caused others to sell the shares and thereby depress the price.

For example, after the Japanese attack at Pearl Harbor the outlook for the automobile industry was recognized as unfavorable. It was widely predicted that the manufacture of automobiles might be stopped completely. Shares of General Motors sold as low as 28⅝. The manufacture of automobiles was in fact stopped completely a few months later and not resumed for several years. However, the bargain hunters, who were willing to act against public opinion and purchase General Motors below 30 after Pearl Harbor, were well rewarded because the shares were later split 2-for-1 and are now selling at 47.

(2) 长期内在价值投资者不要期望购入公司股票后立即盈利

In the second place, the investor who selects stocks on the basis of long-term intrinsic value should not expect that the stocks selected will immediately begin to show a profit. If the intrinsic value of a stock is estimated at $40 and then over a period of years unfavorable news depresses the price to $20, the investor may begin to buy this stock because it appears to be one of the best bargains in the market. However, it would be an unusual coincidence if he should happen to make the purchase just at the time when the downward trend is reversed. Ordinarily the downward trend persists for at least a few weeks and sometimes much longer. The investor may hold the shares for a long time before others begin to recognize the intrinsic value.

从净资产收益率, 盈利分红率方面考虑.

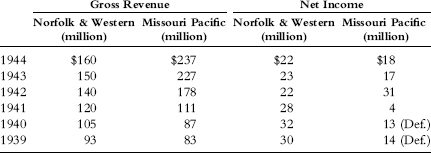

Usually a stock selected for purchase because its market price is very low in relation to intrinsic value sooner or later attracts public favor so that the market price rises above intrinsic value. Even if the stock does not become popular, however, the investment may prove lucrative in the long run. For example, if you can purchase at $20 a stock having $20 a share in assets, earning 20 percent annually on assets and paying out half of earnings, then simply by holding this stock for five years you will receive more than $10 in dividends and more than $10 in the form of increased assets per share. In other words, you may obtain even 100 percent profit on the investment even though the stock continues to be unpopular and sells equally low in relation to earnings, dividends and asset values. Whenever you can buy a large amount of future earning power for a low price, you have made a good investment. (See Table Below)

通常一只因为其股价相对于内在价值过低而买进的股票迟早会引起大众的兴趣,而使得市价回升至内在价值之上。但是即使股票没有变成大众热点,在长期该投资还是会被证明是有利可图的。比如,如果你买入一只20美元的股票,那么每股有20美元的资产,其每年可以产生20%的盈利且将其中一半派发投资者,仅持有该股5年,你就能收到超过10美元的股息且每股资产也将增加超过10美元。换言之,尽管该股票仍然不热门且以相对盈利、股息和资产价值更低的股价交易,你仍然可能得到100%的投资利润。无论何时你能以低价买入大量的未来赢利能力,这都是一笔好投资.2

ChangeLog

@Jeremy Anifacc

2019-06-14

人生苦短, 为欢几何.